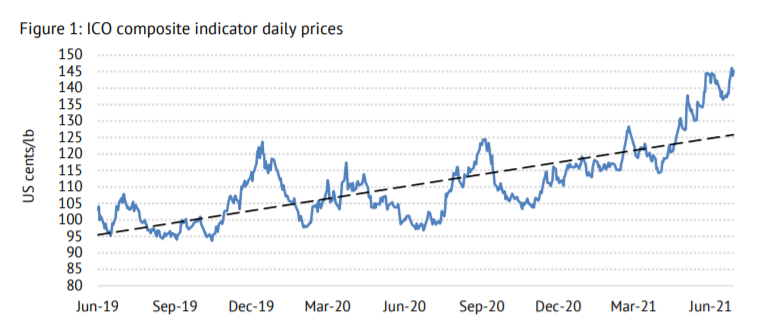

ICO June Report: the upward trend in coffee prices continues

The upward trend in coffee prices continued in June 2021 as concerns about supply from major origins remained the key factor in the market

ArtOn Café is proud to publish a monthly abstract of the ICO reports. On our website we have added the graphs of the London and New York stock exchanges. The former concerns Robusta coffee, while the latter refers to Arabica coffee. We have also added an interesting banner that presents the EUR to USD exchange rate. Please visit our website to access all these details.

Source: ICO

The following is an excerpt from the ICO market report of June 2021:

In June 2021, coffee prices recorded the eighth consecutive month of increase, triggered by the expectations of reduced supply from some origins in addition to disruptions in trade flows. The monthly average of the ICO composite indicator reached 141.03 US cents/lb in June 2021, representing an increase of 33.2% from the level of 105.85 US cents/lb recorded in October 2020. This is also the highest monthly average since the level of 145.82 US Cents/lb registered in November 2016. Prices of all four groups of coffee have recorded a substantial increase. Increased activities of non-commercial speculative sector were also recorded in June 2021, as growing net long positions supported price trends upward.

In terms of market fundamentals, exports by all exporting countries to all destinations totalled 9.8 million 60-kg bags in May 2021, a drop of 10.1% compared with 10.9 million bags in May 2020. The level of total exports in May 2021 represented a 21.5% reduction of the volume recorded in May 2019, before the pandemic. The availability of containers for shipments continue to be a major constraint to trade flows. However, total exports over the first eight months of coffee year 2020/21 amounted to 87.3 million bags, compared with 85.4 million bags during the same period in coffee year 2019/20. Cumulative exports from June 2020 to May 2021 are estimated at 129.2 million bags, a relatively stable level compared with the 129.4 million bags recorded from June 2019 to May 2020. World consumption for coffee year 2020/21 is projected at 167.23 million bags, an increase of 1.9% on its level of 164.01 million bags in coffee year 2019/20. Total production for coffee year 2020/21 is estimated at 169.50 million bags, representing a 0.3% increase on 168.94 million bags in coffee year 2019/20. Although world consumption is increasing, it remains 1.4% below world production. Moreover, in coffee year 2021/22 the supply/demand ratio is expected to reverse as world production will barely meet world demand.

Source: ICO Coffee Market Report – June 2021

Market report concerning Peru and Ethiopia and the GBP to USD and EUR to USD exchange rate

Except for the pictures, the following is an excerpt from the Fortnightly Market Report 13/07/21:

Origin

The vaccination rollout in Peru is going slow, but it is progressing. It’s expected that at the end of July a large number of vaccines will arrive, but it’s still unclear how they will be distributed. The main areas of concern are the larger cities of Lima, Piura, Cuzco and Arequipa. Arequipa, in particular, is going through a challenging period. In Jaen, the coffee capital of the north, the situation has improved. However, hospitals are at full capacity even there, and it’s difficult to find beds for new patients. Nevertheless, the harvest is well underway, and next month we will see FOB shipments start to ramp up, peaking in October/November.

Lima, Peru, March 16,2018: Expoferia of Holy Week of Junín 2018, a fair where typical products of the area are exhibited, such as coffee, honey, maca, as well as drinks and typical foods

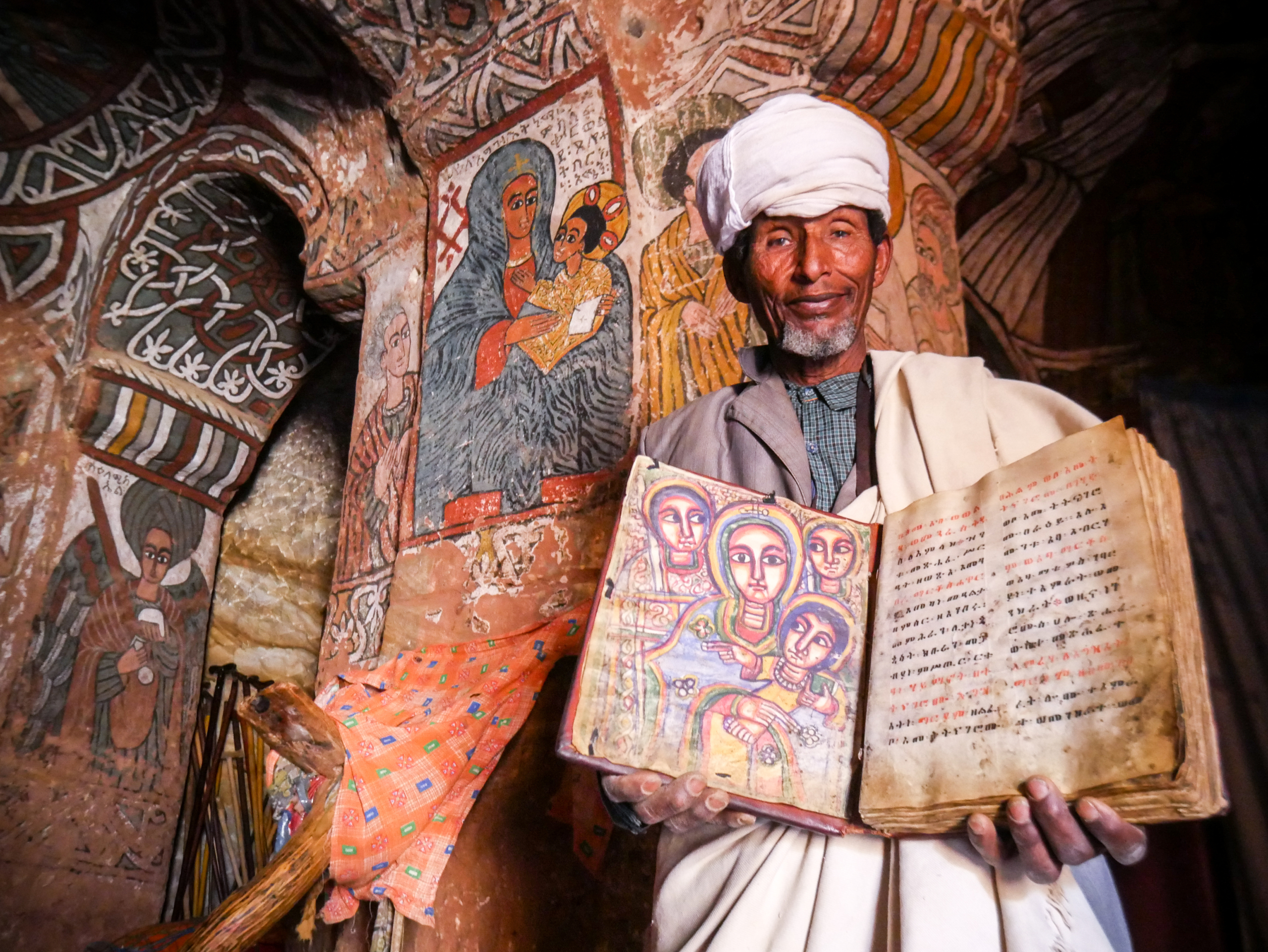

There has been much coverage about Ethiopia and the Tigray region. A few weeks ago, the Tigrayan fighters defeated two of Africa’s largest armies, Ethiopia’s and Eritrea’s, to reclaim Mekelle, their capital. The longer the war goes on, the more work will be needed to unite the various federations that comprise Africa’s second-most populous country. On the weekend, the incumbent President, Abiy Ahmed, the first Oromo to lead the country, won another general election. This means he will stay in power for another term. How he manages Tigray will likely define his next term.

Hawzen woreda of the Tigray Region, Ethiopia – February 1st 2017: A priest with an ancient goat-skinned Bible inside the 5th century rock-hewn Abuna Yemata Church

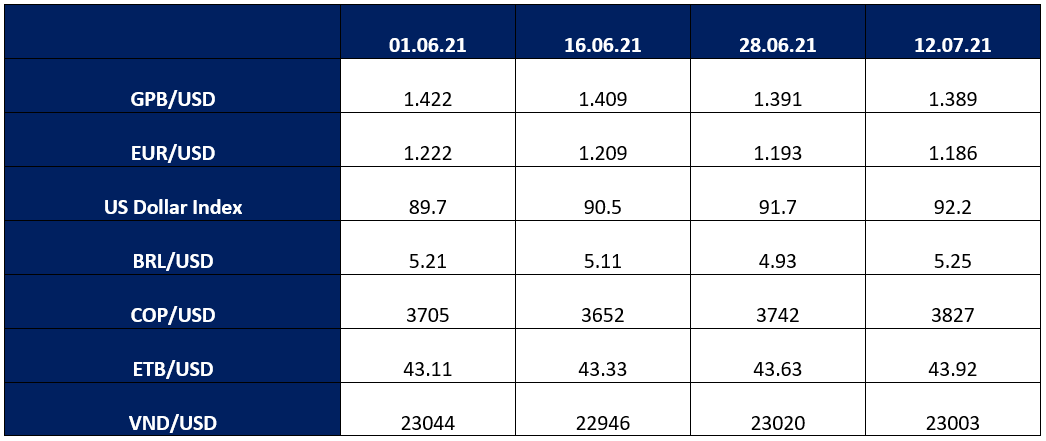

GBP/USD

The US Dollar strengthened against its key currency pairs, with the USD index surpassing 92, a level we have not seen since April. If the global recovery picks up the pace we may see the USD weaken as money is directed away from this safe haven. However, with so much uncertainty still ongoing, this USD strength could be here for longer than the short term. The decision by the Bank of England to keep rates on hold and maintain the current asset purchase target on the 24th of June encouraged a further loss in value of Pound Sterling against the USD. GBP/USD started the fortnight trading at 1.388 and slumped to a low of 1.367 on Thursday 1st of July. It finished the fortnight back up at 1.388. Although it did lose a great deal of value against the Greenback over the past six weeks, it fared comparatively better than most other G10 currencies over the same reporting period.

British one Pound coin. The word “One Pound” in a main focus

EUR/USD

Unlike the Pound, the Euro was of the G10 currencies that underperformed against the USD. It opened Monday 28th June at 1.192, representing the highest value it would post over the fortnight. The Eurozone economic recovery may have provided support to the Euro, but European Central Bank President, Christine Lagarde, said it was at risk of losing momentum due to the mutating virus, even as the vaccination programmes gather momentum. “Of course, the nascent recovery still faces uncertainty also due to the spread of virus mutations,” she said. EUR/USD fell to a low of 1.178 on the 7th of July and managed to claw back some value by Friday’s finish, closing out at 1.187.

Euro Symbol in a digital raster micro structure – 3D illustration

The ECB is beginning to debate whether to cut back on its massive bond-buying programme as the economy emerges from its coronavirus-induced slump, as divisions emerge between policymakers in different countries. This uncertainty, coupled with the Fed’s movements that are increasingly hard to predict, is leaving everyone guessing as to where the currency markets are going.

FX Data

References

DRWakefield. (2021). Fortnightly Market Report 13/07/21. Retrieved July 16, 2021, from Market Reports website: https://drwakefield.com/market-reports/fortnightly-market-report-13-07-21/?utm_source=Newsletter+Mailing+List+May+2018&utm_campaign=6e3b4e90ba-EMAIL_CAMPAIGN_2020_02_12_11_58_COPY_01&utm_medium=email&utm_term=0_d2aa19fb26-6e3b4e90ba-434305845

ICO. (2021). Coffee Market Report June 2021. Retrieved from https://www.ico.org/documents/cy2020-21/cmr-0621-e.pdf

Pictures: when not otherwise specified, the pictures were purchased by the ArtOn Café director